Cases: Pasadena reported 20 new cases of COVID on Thursday. There were no new fatalities. LA County reported 1,233 new cases on Thursday and 14 deaths related to COViD-19.

New Variants: Signs hint at a winter COVID wave. Coronavirus cases tied to subvariants are rising as a long decline in infections flattens. By Luke Money and Rong-Gong Lin II for the LA Times.

Amid concerns about a potential winter COVID-19 wave, cases linked to newer coronavirus subvariants are starting to creep up in California as officials in Los Angeles County and the San Francisco Bay Area warn that a lengthy decline in new infections appears to be stalling. Whether this trend in coronavirus cases can be blamed on the rise of the newer strains is unclear — especially since the Omicron subvariant BA.5 remains the dominant version nationwide, as has been the case for months.

But officials have long warned that any new subvariant could imperil the progress against COVID-19, either by being inherently more infectious or better able to evade protection from vaccinations or previous infections.

A few other Omicron subvariants also have risen in prominence. BQ.1.1 , which some officials have pointed to as a potentially problematic strain, went from an estimated 0.2% of cases nationwide in mid-September to 7.2% this month. During that same time, BQ.1 has swelled its estimated share from 0.5% to 9.4%, while BF.7 — also known as BA.5.2.1.7 — has increased from 1.9% to 6.7%.

In L.A. County, data from the week ending Oct. 1 also point to a decline in BA.5’s dominance and new subvariants making up an increasing share of cases.

But while BQ.1 and BQ.1.1, both descendants of BA.5, are gaining ground nationwide, only a handful of such cases have been documented in L.A. County. Seven have been attributed to BQ.1 and three to BQ.1.1.

Another Omicron subvariant, BA.2.75.2, represents only 0.2% of cases per week in L.A. County, a rate that has been stable for three weeks. L.A. County also has not reported any cases of the XBB subvariant that has been spreading in Singapore, according to Ferrer.

While newer strains have some mutations that could provide a growth advantage, it’s unclear whether any will cause more severe symptoms than their predecessors.

And many officials and experts remain generally optimistic that available vaccines — particularly the recently released bivalent boosters — should continue to provide strong protection against the latest round of subvariants.

California has made significant progress since the height of last summer’s COVID wave, with cases and hospitalizations plunging in recent months. But those declines may be slowing.

L.A. County reported 874 coronavirus cases a day for the seven-day period that ended Friday, or 61 cases a week for every 100,000 residents. That represents an 8% decline from the previous week. By contrast, the previous week-over-week decline was 17%.

The San Francisco Bay Area reported 60 cases a week for every 100,000 residents for the seven-day period that ended Tuesday — no change from the prior week. The previous week-over-week decline was 15%.

Previous COVID surges have largely coincided with the emergence of a new coronavirus variant or subvariant. That BA.5 could apparently strike twice “means that waning immunity, changing weather and/or changing behaviors are the culprit,” according to Willis.

On Wednesday, the CDC allowed the Novavax COVID-19 vaccine to also be used as a booster for adults. But that offering is designed against only the original coronavirus strain, not the BA.4 and BA.5 variants.

For most people, a recent infection really does boost the immune system, but that immunity can vary for each person. Overall, Ferrer suggests residents get boosted by the end of October or the start of November.

Vaccines aren’t the only option for warding off COVID-19. A number of therapeutics — including remdesivir and bebtelovimab, which are administered intravenously, and Paxlovid and molnupiravir, which can be taken orally — can help stave off severe illness and death.

From the New York Times: Several new Omicron subvariants have been steadily gaining ground in the U.S., setting off alarm bells ahead of fall and winter, when experts say we can expect to see another Covid surge.

They include BQ.1 and BQ.1.1, which currently account for 11 percent of cases in the U.S., up from about 3 percent two weeks ago. Other Omicron offshoots are also growing steadily, including BA.4.6, BF.7 and XBB, which has been spreading quickly in Singapore.

What do we need to know about these new variants? All these variants are new versions of Omicron. Omicron showed up almost a year ago, it took over, and it’s been evolving ever since. Some of those mutations are making the variants able to get around the immunity that people may have gotten from being infected by the coronavirus before — even by earlier forms of Omicron.

How will these variants play out in the coming months? It’s very hard to predict exactly what will happen, and it’s probably going to be different in different places. So one country may see one variant become dominant, and in another country, a different one may emerge. But the key thing is that there are a bunch of different versions of Omicron that are really good at spreading, and they have the potential to make a bad situation worse.

How so? Winter is coming to the northern hemisphere, so a lot of people are going to be spending a lot of time inside with other people. A lot of people have also decided for themselves that the pandemic is over, and so there’s a lot less wearing of masks. On top of that, the immunity that people may have is waning. So even if there weren’t a lot of new Omicron variants to worry about, this could potentially be a challenging winter. These new variants make it even more concerning because they all have a lot of mutations that we already know are good for evading immunity and spreading quickly.

How worried should we be? Importantly, there’s no evidence that these new variants cause more severe disease. But the Omicron surge last winter showed us that if a so-called mild variant infects a huge number of people, hospitalizations surge. On the other hand, if there were a totally new variant that came out that could raise people’s odds of ending up in the hospital and of dying, that would be a lot worse.

It’s important that people get vaccinated. And if they haven’t gotten boosters, they need to get boosters. I have seen some projections showing that better vaccine coverage could save many thousands of lives this winter.

What if I’ve already been infected with Omicron? As far as we can tell, that previous infection will give you some protection. But some protection means you could still get sick.

How are our tools to fight the virus holding up? That’s a serious problem with these new variants. As the variants develop mutations that evade our immune systems, they are also becoming able to resist some of the monoclonal antibodies that have been so effective until now. Companies have developed newer monoclonal antibodies that can work, but it takes a long time to get them through the approval process.

Is there any good news? Fortunately, Paxlovid works against these new variants. The mutations that make them spread so quickly are changes to the surface of the virus where it locks onto cells and where antibodies attach to it. Paxlovid attacks the virus in a different way. It detects the virus after it’s inside the cell and is replicating, and these new subvariants seem to be just as vulnerable to Paxlovid as the earlier variants.

The Economy: Fed officials are likely to raise rates by three-quarters of a point next month. Plans for another big increase came after more signs of persistently high inflation, suggesting a need to keep cooling the economy. One small upside to inflation: Many Americans will probably pay less in taxes next year.

From the New York Times: Political and economic crises typically have multiple causes. But many right now are driven by one main factor: the rising cost of living.

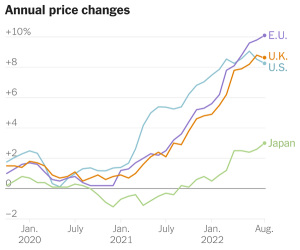

This chart by Ashley Wu shows how quickly prices have risen across many of the world’s advanced democracies. Officials generally aim to keep the rate of inflation around 2 percent — enough to keep the economy growing yet preserve stability in prices. Many of the countries are at least four times above that pace:

By German Lopez: Europe’s inflation crisis is different from America’s.

Global costs: Political and economic crises typically have multiple causes. But many right now are driven by one main factor: the rising cost of living.

In Britain, Prime Minister Liz Truss resigned after just six weeks in office over a now-abandoned tax cut plan that experts warned would worsen inflation, if not wreak economic havoc. Europe is bracing for skyrocketing energy costs this winter. In the U.S., the Federal Reserve is considering more aggressive steps to bring down price increases, but its moves could also cause a recession, as The Times reported yesterday.

So what happened? It helps to think of inflation as two related crises instead of one. In the first, global disruptions from the pandemic and Russia’s invasion of Ukraine prompted inflation to spike around the world. In the second, some countries — particularly the U.S. — also made inflation worse for themselves through domestic policy decisions. In today’s newsletter, I’ll explain both.

Global trends: From 2020 to early 2022, Covid largely explained the trends on the chart. The pandemic and its fallout created a supply shortage (factories closed and logistics chains sputtered) and a spike in demand (for purchases like home furniture and airfares). That imbalance prompted price increases.

The chart’s trends show a change near the beginning of this year. From last year until early 2022, prices in the U.S. rose more quickly than in the other countries. But the E.U. and Britain are now ahead, as data released today demonstrates. (The outlier is Japan, which has dealt with a stagnating economy and deflation for decades.)

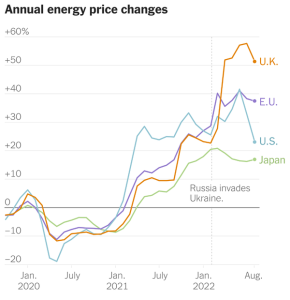

Europe began outpacing the U.S. when the war in Ukraine created its own disruptions. Russia’s invasion shut down Ukraine — one of the world’s breadbaskets and a major exporter of grain — and raised food prices. And Western sanctions in response to the war cut off Europe from Russian oil and gas, on which the continent relied heavily. So worldwide energy prices went up, too.

As this second chart by Ashley shows, Europe took the hardest hit. The war affected energy costs in other parts of the world, but countries less dependent on Russian oil and gas adapted more quickly:

Chart shows annual change in energy prices each month through August 2022. | Source: O.E.C.D.

Europe’s challenge now is finding alternative energy sources. Building up the infrastructure, after dedicating pipelines and terminals to Russian oil and gas, will take time.

Even countries with bigger buffers from the supply shock are taking steps to address energy prices. The Department of Energy is planning to release 15 million more barrels of oil from strategic reserves.

Domestic causes: Government responses to the global crises also influenced inflation, at times making it worse than it otherwise would have been.

Policymakers’ initial instinct during the pandemic was economic preservation. To prevent Covid from setting off a deep recession, they enacted relief measures. In some cases, they might have gone too far: The point of stimulus packages is to elevate spending and demand, keeping the economy afloat. But if supply can’t keep up with the new demand, prices will rise.

Once they did, central banks were also slow to respond — believing that the inflation would subside as the impact of global catastrophes like the pandemic faded. So inflation increased unchecked.

The U.S. suffered from both problems. America spent among the most of any country in the world on economic relief, likely leading to too much demand and then worse inflation. And for much of 2021, the Federal Reserve viewed rising prices as a temporary phenomenon; it didn’t acknowledge that inflation was enduring until late last year.

That combination of overstimulus and central bank inaction helps explain why the U.S. had the highest inflation rate among its peers until Russia’s invasion of Ukraine.

If it weren’t for the war, the U.S. could still be worse off than the others. America still has a higher core inflation rate, which excludes food and energy prices, than many of its peers — indicating it has deeper problems than the global events that are primarily driving up food and energy costs. The labor market in particular remains hot, with an unusually high number of job openings for each unemployed worker. These are the problems that the Fed is trying to address without causing a deep recession (as I explained in this newsletter).

In simple terms: Inflation is the big problem. But in Europe, the causes and solutions are related to supply. And in the U.S., they are more about demand.

The U.S. will release more oil to blunt gasoline price increases. President Biden is expected to announce today that the Energy Department will release 15 million more barrels from the Strategic Petroleum Reserve. The move comes as the price of Brent crude oil dropped below $90 a barrel yesterday, for the first time in two weeks.

Housing: from Jonathan Lansner in the Pasadena Star-News: The bubble burst. Again. Home values face significant dips as rising mortgage rates and economic unease crush affordability and house hunters’ will to buy. Most notably, the California Association of Realtors forecasts a 9% drop in values statewide for 2023.

The pandemic played havoc with the broad economy, but surprisingly, it served as a boost for housing. A buying binge emerged as folks sought larger living quarters and real estate investments while mortgage rates hit record lows.

When mortgage rates are lower than inflation, be scared.

April 2021 saw inflation — 4.2% and a 13-year high — top the average 30-year mortgage rate, which was at a near-record low of 3.1%.

This kind of inversion hadn’t been seen in 41 years. Mortgages, on average, run 4 percentage points above inflation.

This hinted inflation was a growing problem. Rates would rush higher as the Federal Reserve used pricier financing in a so-far failed attempt to chill an overheated economy.

Even in September 2022, the Consumer Price Index was surging by 8% a year. The 30-year mortgage rate had only surpassed 6%, effectively crushing homebuying affordability.

Americans with homes for sale are going through the five stages of grief.

Mortgage rates have risen at the fastest pace in decades. Buyers either are moving to the sidelines or are priced out altogether, causing price drops in expensive markets like California.

And the number of homes for sale is on the rise — not because new listings are coming on the market, but because more homes are sitting longer without an offer.

“We’re in the midst of a housing resetting,” said Lisa Sturtevant, chief economist for the Bright MLS, one of the nation’s largest multiple listing services. “Sellers are definitely resetting their price expectations. Slowly. They’re going through the five stages of grief. They’re understanding that market conditions are changing. But many times, sellers are still trying to overreach on price.”

Sturtevant was one of a half-dozen economists sharing their outlook for the housing market at the National Association of Real Estate Editors conference in Atlanta earlier this month.

They all agreed the housing market is going through a slowdown likely to last through much of 2023.

Lawrence Yun, chief economist for the National Association of Realtors, forecast the 2022 home-sale tally will land 15% below last year’s levels, and sales will fall an additional 7% in 2023.

U.S. home prices will be flat next year, he predicted, rising in about half of the country and falling in the other half.

Where will price drops most likely occur? “California will be a prime target for price declines,” Yun said. “Whether it’s going to be a 5% or 10% price decline (is uncertain). But I think it’s most assured the California market, expensive areas will undergo some price adjustment.”

Wall Street may not reflect the economy that matters to most people: Much of the attention on Goldman Sachs’s earnings focused on the Wall Street firm’s reorganization, which de-emphasizes traditionally profitable, if volatile, businesses like M.&A. advice and elevates steadier operations like asset and wealth management. (It also splits up Goldman’s struggling consumer-lending unit.)

But those results also highlight a split in big banks’ fortunes. Goldman and Morgan Stanley, which rely more on traditional Wall Street businesses, suffered from a slowdown in high-finance activities like deals and I.P.O.s that led to drops in revenue. By comparison, lenders like Bank of America, JPMorgan Chase and Wells Fargo that rely on Main Street for more of their business reported sales gains.

Not surprisingly, the latter group has outperformed the former as investors have broadly acquired bank stocks. Over the past five days, financials is the leading S&P 500 sector, up 6.4 percent, according to Fidelity.

Time to book that flight: If you’re traveling for the holidays, buy your airfare as soon as possible. “The best time to have booked those Thanksgiving and Christmas flights was June and July,” says Scott Keyes, the founder of Scott’s Cheap Flights. “And the second best is basically now.”