U.S. Economy Grew at 3.3% Rate in Latest Quarter-from the New York Times: The increase in gross domestic product, while slower than in the previous period, showed the resilience of the recovery from the pandemic’s upheaval. By Ben Casselman

The U.S. economy continued to grow at a healthy pace at the end of 2023, capping a year in which unemployment remained low, inflation cooled and a widely predicted recession never materialized.

Gross domestic product, adjusted for inflation, grew at a 3.3 percent annual rate in the fourth quarter, the Commerce Department said on Thursday. That was down from the 4.9 percent rate in the third quarter but easily topped forecasters’ expectations and showed the resilience of the recovery from the pandemic’s economic upheaval.

The latest reading is preliminary and may be revised in the months ahead.

Forecasters entered 2023 expecting the Federal Reserve’s aggressive campaign of interest-rate increases to push the economy into reverse. Instead, growth accelerated: For the full year, measured from the end of 2022 to the end of 2023, G.D.P. grew 3.1 percent, up from less than 1 percent the year before and faster than the average for the five years preceding the pandemic. (A different measure, based on average output over the full year, showed annual growth of 2.5 percent in 2023.)

There is little sign that a recession is imminent this year, either. Early forecasts point to continued — albeit slower — growth in the first three months of 2024. Layoffs remain low, and job growth has held steady. Cooling inflation has meant that wages are again rising faster than prices. And consumer sentiment is at last showing signs of rebounding after years in the doldrums.

“It’s hard to imagine how things could look better for the soft landing,” said Brian Rose, senior economist at UBS. “Looking back at last year, the combination of growth and inflation that we had was not considered in the realm of possibility by most people. To have such strong growth, low unemployment and to have inflation coming down that quickly, even the optimists weren’t that optimistic.”

The fourth-quarter data provided more evidence that the recovery remains on solid footing. Consumer spending, the bedrock of the U.S. economy, grew at a 2.8 percent annual rate, only modestly slower than the prior quarter. The housing sector, which was battered by high interest rates in 2022 and early 2023, grew modestly for the second quarter in a row. Businesses stepped up their investment on equipment. Personal income rose faster than prices as the strong job market continued to benefit workers.

Perhaps most significantly, inflation continued to cool: Consumer prices rose at a 1.7 percent annual rate in the final three months of the year, below the Fed’s long-run target of 2 percent. (Measured from a year earlier, prices were up 2.7 percent.) That isn’t just good news for households bruised by two years of rapidly rising prices; it also makes a recession less likely, because it gives Fed policymakers more flexibility to cut interest rates to keep the recovery on track.

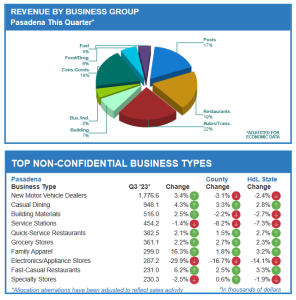

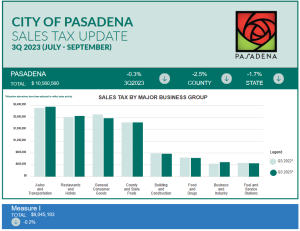

Pasadena's Sales Tax revenue dropped .03% (essentially the same) for the third quarter (July to September, 2023) over the previous year's data. Sales tax is a good indicator of retail sales activity in the city.

A report from the Department of Finance notes: "Pasadena’s receipts from July through September were 3.0% below the third sales period in 2022, though this was artificially deflated by a home furnishing vendor’s payment error. Excluding this and other reporting aberrations, actual sales were down 0.3%, outperforming the state and regional trend. The largest contributor to this decline was a drop in tax receipts from electronics, appliances, home furnishing, and specialty stores as consumers shifted their spending away from the purchase of tangible goods to leisure, entertainment, and travel. The increase in family apparel spending was the exception to the general downturn in the general consumer goods industry group as shoppers searched for back-to-school deals at off- price retailers and as several new store openings further boosted returns.

New car dealerships also posted a positive return, outperforming most jurisdictions throughout the State. Pasadena’s voter-approved 0.75% district tax, Measure I, performed similarly to the Bradley-Burns results previously discussed. Net of aberrations, taxable sales for all of Los Angeles County declined 2.5% over the comparable period; the Southern California region was down 1.4%."

TOP 25 SALES TAX PRODUCERS CITY OF PASADENA HIGHLIGHTS

• Apple

• Audi & Bentley Leasing

• Best Buy

• Brookside Golf Club at

• the Rose Bowl

• Cadillac Pasadena

• Enterprise Rent A Car

• Ganahl Lumber

• Home Depot

• Honda of Pasadena

• Land Rover Pasadena

• Langham Huntington

• Hotel & Spa

• Macy’s

• Marshalls

• Nordstrom Rack

• Pasadena Volkswagon

• Ralphs

• Ross

• Rusnak Ineos Grenadier

• Volvo Porsche

• Target

• Tesla Motors

• Thorson GMC Buick

• Toyota of Pasadena

• United Oil

• Vons

• Whole Foods Market

The One Part of the Housing Market That’s Growing-From the New York Times: As owners remain reluctant to put their properties on the market, developers are rushing to build new homes to meet demand. By Gregory Schmidt

The housing market has been mired for much of the past year, bogged down by high prices, soaring mortgage rates and a dearth of inventory, pushing many would-be buyers to the sidelines.

Existing homes typically account for about 90 percent of sales, but homeowners who have locked in low-rate mortgages have been reluctant to sell, resulting in limited choices and sky-high prices for prospective buyers. Last year, existing-home sales fell to the lowest level in nearly 30 years, while the median price hit a record high, according to a recent report by the National Association of Realtors.

That spurred a rise in construction, as developers rushed to meet demand and dangled incentives to entice buyers. Sales of new homes jumped 4.2 percent last year from 2022, the Census Bureau reported on Thursday.

Buyers are providing a jolt to the economy; residential investment, which includes the construction and purchase of new homes, jumped in the second half of last year, rising at a 6.7 percent annual pace in the third quarter and 1.1 percent in the fourth, the Commerce Department reported on Thursday.

That is a boon for developers like Howard Hughes, which in its most recent earnings report said it sold twice as many new homes in the third quarter as it had the year before. “Our job is to make sure we have enough houses to meet that buyer demand,” said David R. O’Reilly, the company’s chief executive.

Since March 2022, the Federal Reserve has increased interest rates 11 times in an effort to tamp down inflation. That led to higher mortgage rates: After falling below 3 percent during the pandemic, the average rate for a 30-year fixed-rate mortgage jumped above 7 percent last summer, and has recently hovered around 6.7 percent, according to Freddie Mac.

Home prices nationwide inched up 0.4 percent in December from the month before, the third straight month of slower growth and the smallest increase since June, according to a report from Redfin, a real estate services company.

New homes are typically more expensive than existing ones, and builders are reconfiguring floor plans and shrinking room sizes in an effort to appeal to budget-conscious buyers.

Sellers of new homes are also offering incentives like discounts on mortgage rates and upgraded features like new appliances and countertops.

The Public Policy Institute of California is out with its deep dive into the California population, issuing a fascinating synopsis of the comings and goings of the state’s residents. With more than 39 million people, we’re still the top dog in the U.S. population contest. As always, Texas and Florida (31M and 23M, respectively) are nipping at our heels.

Pandemic times were tough on everyone, but we took it to another level, losing a whopping 433,000 people. Birth rates hit a low while COVID-19 spiked death rates — not exactly the balance we're looking for. The state remains a bastion of diversity: 40% Latino, 34% White, 15% Asian/Pacific Islander, 5% Black and 5% multiracial. We’re also a state of immigrants: 10 million call California home, making up 27% of the population. And while California is aging gracefully, it's still younger than most, with a median age of a cool 37.9 years. (We’re hip Millennials!)

Political side effects? Losing a congressional seat is just the start. We might have dropped three if they'd counted later. Rural areas and L.A. County are losing their voice, while areas like the Inland Empire are getting louder. And with conservatives more likely to leave, California’s leftward tilt just might get a bit more pronounced.